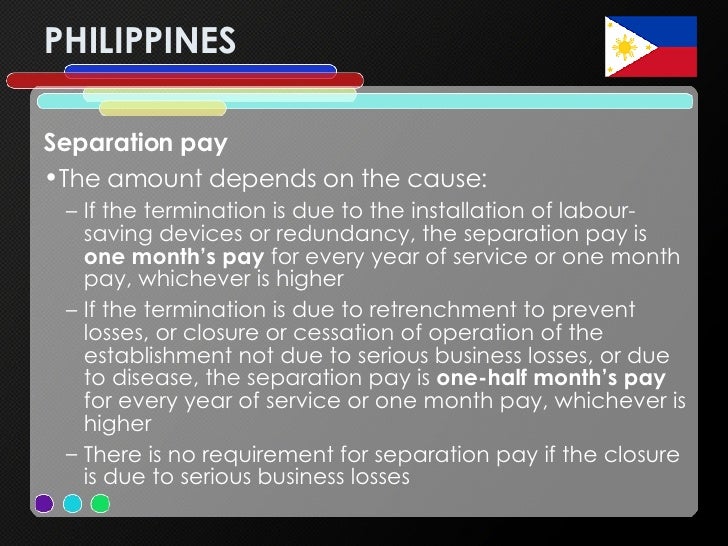

How to Terminate an Employee on the Ground. Dismiss workers on the ground of retrenchment to prevent serious losses is. To retrenchment in the Philippines. Applied Philippine. When there is redundancy? What are the requisites for redundancy to be an. What are the requisites for redundancy to. Aplikasi Tv Offline Tanpa Tv Tuner. THE LABOR CODE OF THE PHILIPPINES – BOOK 6. In case of termination due to the installation of labor-saving devices or redundancy. Digital Telecommunications Philippines. He said Digitel has had to conduct this redundancy program following the decision to migrate over 140,000.

Any amount received by an official or employee or by his heirs from the employer due to death, sickness or other physical disability or for any cause beyond the control of said official or employee such as retrenchment, redundancy, or cessation of business are exempt from withholding tax on compensation. Amounts received by reason of involuntary separation remain exempt from income tax even if the official or employee, at the time of separation has rendered less than 10 years of service and/or is below 50 years of age. =========================================== Pre-week Beda Sample Problem Due to business reverses, Kawawa Corp.

Offered a voluntary redundancy program under which an employee who offered to resign would be given separation pay equivalent to 3 months basic salary for every year of service. A accepted the offer and received P300,000.00 as separation pay under the program. The firm adopted another redundancy program where various unprofitable departments were closed.

As a result, B was separated from the service. He also received P300,000.00 as separation pay. Will the separation pay of A and B be subject to tax? A’s separation pay will be subject to tax because of the voluntary action on his part. He may, however, avail of the tax-free retirement provided that he is 50 years or over, that he has rendered at least 10 years of service with Kawawa Corp., and that he has not previously availed of the tax-free retirement.

4d Games For Pc. B’s separation pay will not be subject to tax because he was separated for a reason beyond his control. RETIREMENT RETIREMENT AGE -The age of retirement is that specified in the CBA or in the employment contract. If it is not specified, 1. 60-65 -retirement is optional but the employee must have served at least 5 years; 2. 65-compulsory retirement age ( no need for 5 years of service) BENEFITS- A retiree is entitled to a retirement pay equivalent at least ½ month salary for every year of service, a fraction of at least six (6) months being considered as one whole year.

Unless the parties provide for broader inclusions, the term “one half (1/2) month” salary shall mean: • 15 days plus 1/12 of the 13th month pay and • the cash equivalent of NOT more than 5 days of service incentive leaves. (22.5 days per year of service) =========================================== Pre-week Beda Sample Problem 30. What are the conditions necessary to exempt retirement benefits from income tax? Under RA 4917, retirement benefits are exempt from income tax if the following conditions are present: a.

The retiring official or employee has been in the service of the same employer for the last ten years; b. He is not less than fifty years old at the time of his retirement; and c. The official or employee avails of the benefits only once; and d. Under Revenue Regulation 2-98, the private benefit plan is approved by the BIR.

The NLRC Resolution puts to rest the labor dispute between Digitel and a group of complainants in the Digitel Employees Union (DEU), which had questioned the Digitel redundancy program carried out in early 2013. With the NLRC Resolution, these 86 remaining DEU group members are now entitled to separation benefits from the redundancy program, as well as backwages from March 16 to July 30, 2013, and their separation can take immediate effect. The NLRC Resolution denied the DEU Motion for Reconsideration. It also confirmed the findings in the NLRC's March 18, 2014 Decision, that the Digitel telecommunications network had reached its 'end of life' stage, and that it was financially impossible for Digitel to have upgraded and modernized its network -- leading to the migration of Digitel subscribers to PLDT. Because the redundancy program was a consequence of these events, the NLRC concluded that the separation of the entire Digitel workforce was done in good faith.

The Resolution also upheld the finding that almost all of Digitel's thousand-person workforce voluntarily availed of the redundancy program, except for the 86 DEU group members. This means that the bargaining unit the DEU alleged it represented, has ceased to exist, and DEU has no right to demand collective bargaining with Digitel.