Introduction: It’s often suggested that forex and markets in general are a succession of random movements, a random walk. People trade based on logical reasoning but there are so many people affecting the same value that the movements of a price become impossible to tell apart from a random walk. With a simple method of random walk visualization, we can easily show that the above theory is incorrect.

Picktorrent: random walk trading. Wall Street Expert - 15 trading system ebook course for forex futures emini options and stock market trading rar: Book. Always Walk Forward Rar Ebook Full Free. Download Walk Forward Analysis Le Cantonate Di Robert Pardo Come Fare Trading Vol 26. We share our archive to make your. Random Walk Trading. 81 views; 3 years ago; 1:14. Play next; Play now; Vertical Spread Questions - Duration: 74 seconds. Random Walk Trading.

Especially for short periods like ticks, prices tend to travel in easily identifyable trends, much more so than a random instrument would. Random walk vs tick data First let’s see what pure randomness, as far as computers can generate it, looks like: The pictures above are generated by a random walk.

On each step, the position has a 50/50 chance of going up or down and on the next step, a 50/50 chance of going right or left. The colors change accordingly purely for aesthetics.

Fic Am37-l Drivers. Now we’dlike to do the same using actual tick movements from forex instruments. We generate the following images using forex tick data. We move up or right for rises in price and we move down or left for falls in price. Eroda Gps Software there. We alternate horizontal and vertical movements.

If forex is simply a random walk we expect the same type of pattern-less image as shown above. The graphs obtained for two month of tick data are very different from the random graphs. There is a strong tendency towards diagonal movements that correspond to upward or downward trends. Even as we zoom in to periods without a particular overall trend we observe that the graph is mostly made up of diagonal movements. Diagonals going from top-left to bottom-right, and inversely, indicate trends. Those movements are the most frequent and indicate very short term trends. You’ll only find this pattern with ticks or minutes for a few instruments.

Overall, forex ticks follow trends by almost 70% more than if they moved randomly. Greg Reiter Wicked Game Tab. That means one should be able to predict the next tick movement with 70% accuracy.

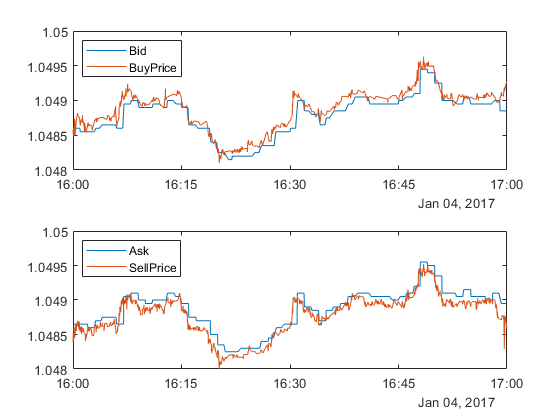

Automated strategy If you simply predict that the next tick movement will be the same as the previous, you’ll be right about 65% of the time and with regression algorithms that are a little more complex you can reach the 70% correct predictions. However, that’s not enough to make a profit because of commission costs and spread. The best results are obtained when using point & figure data with a threshold of 0.5 pip on EURUSD. We can predict with about 60% accuracy the next 0.5 pip movement and by limiting trades to the ones where the regression is very confident, we actually manage a profitable strategy.